Fake Pay Stubs: A Guide to Protecting Your Rental Community

Finding qualified tenants requires a keen eye for detail, especially when it comes to income verification. In recent years, income fraud has become widespread. A recently published survey reported that more than 84% of respondents (landlords and property managers) had encountered fake income verification for apartments on applications. Therefore, it’s important to verify income and ensure your applicants can comfortably afford the rent in order to protect your investment and foster a stable community for your other residents.

But with the rise of online forgeries, fake pay stubs and employment verification are becoming a growing threat. These fabricated documents can lead to missed red flags and risky residents in your communities. This blog post is your guide to equip you with the knowledge to screen residents properly and spot a fake pay stub.

What Are Fake Pay Stubs?

Fake pay stubs are fabricated documents designed to misrepresent an residential applicant's income and employment status. These forgeries often contain details like the applicant's name, address, employer information, salary, deductions, and other financial data, making them appear deceptively legitimate. The rise of online templates and editing tools has unfortunately made it easier for individuals to create fake paycheck stubs for apartment rental applications.

Why Do Applicants Fake Pay Stubs?

The rental market can be competitive and finding a desirable apartment can be a challenge, especially for individuals with limited income or unstable employment histories. In this competitive environment, some applicants may resort to desperate measures, and that's where fake pay stubs come in.

Here are some of the reasons why applicants might try to deceive you with a fabricated pay stub:

- Falling Short of Income Requirements: If an applicant's income falls below the required threshold, they might be tempted to inflate their earnings.

- Spotty Employment History: Gaps in employment or a history of short-term jobs can raise red flags, so some applicants might falsify pay stubs to show consistent employment.

- Debt or Financial Difficulties: An applicant struggling with debt or facing financial difficulties might use a fake pay stub to hide their true financial situation and secure housing.

It's important to remember that not every applicant with a less-than-ideal financial situation will resort to fraud. However, understanding the motivations behind fake pay stubs can help you stay vigilant during the application process.

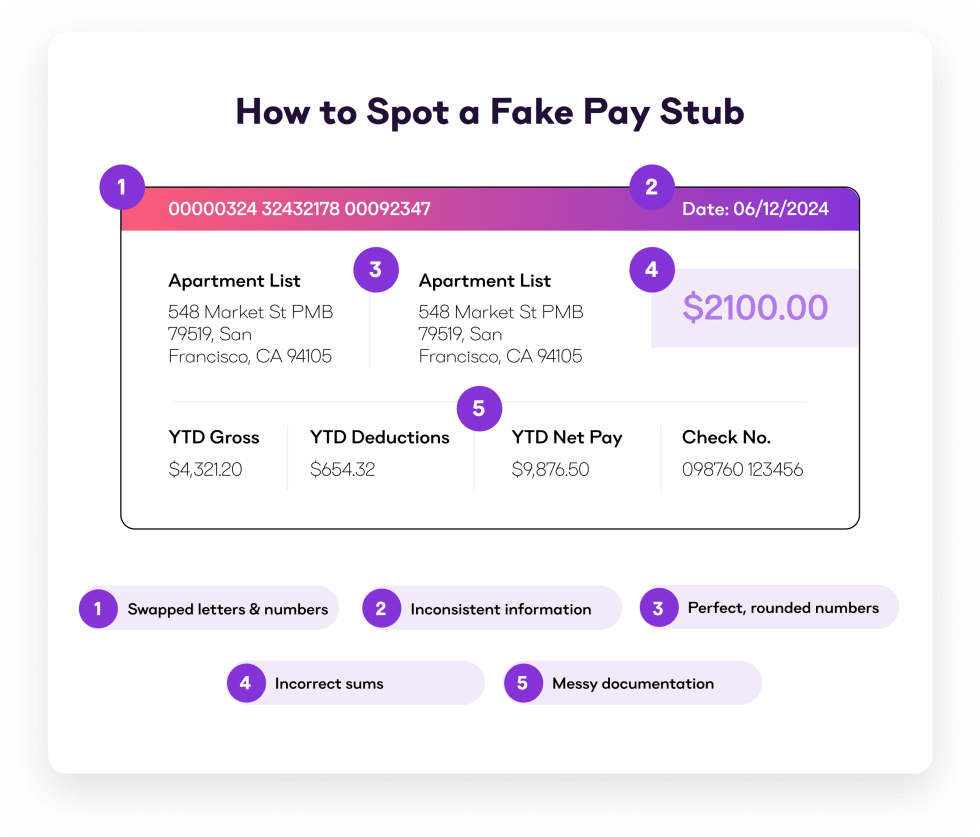

5 Ways to Spot Fake Pay Stubs

Fake pay stubs are a growing risk for landlords, causing vacancies, financial losses, and disruptive tenants. Learn the five key methods to identify these fraudulent documents in the section below.

1. Swapped Letters & Numbers

Take a close look at the letters and numbers on your applicants' pay stubs. For example, the letter "O" may be in the place of the number "0." Or, you might notice the letter "I" and the number "1" are interchanged. Unlike someone trying to fake their pay stub, a professional payroll company won't make the same mistake.

2. Inconsistent Information

Conflicting information is a telltale sign that the check stub is fake. Ensure the tenant's legal name is on the stub and that all the math is correct and consistent.

There may be some exceptions, like a tenant who married and legally changed their last name. If there is a valid reason, ask for documentation or more information about the situation to verify the conflict.

3. Perfect, Rounded Numbers

It's rare to see a real pay stub with a perfectly round number. Instead of $2,500 per pay stub, you should see a number that looks more like $2,538.27 with taxes taken out.

If you're renting an apartment to someone self-employed, they may charge a flat fee per project that results in check stubs with round numbers, but you should ask for additional documents to verify their income.

4. Incorrect Sums

What's going on with the math in the paystubs you receive? Fake ones will have incorrect sums, such as a gross figure that doesn't correlate with the net pay number. The amount of taxes taken out may also look off after making calculations.

5. Messy Documentation

Messy, blurry, and smeared text are indications a prospective tenant is falsifying pay stubs. You might notice the data doesn't line up neatly or the information is only half-printed. The printing may also look blurry or have odd or mismatched fonts.

Use your gut. Pay stubs with information that looks off are likely not real pay stubs, and will require further pay stub verification.

How to Spot a Fake W-2 Like a Pro

Fake pay stubs are a challenge, but fake W-2s can be even more deceptive. Here’s how to spot a fake w-2 and protect your rental community:

- Pay Stub Mismatch: Compare the income on the W-2 to the provided pay stubs. Do the numbers align after accounting for taxes and deductions? Even small discrepancies can be a red flag.

- Tax and Withholding Discrepancies: Research typical tax rates and deductions for the income listed. Do the amounts withheld for Social Security, Medicare, and local taxes seem realistic?

- Fake Employer: Use the Employer Identification Number (EIN) and company name on the W-2 to verify the employer's legitimacy online. Search for the company address, website, and reviews. Does the information seem genuine?

- Formatting Errors: Professional payroll companies produce W-2s with a consistent layout. Look for minor formatting errors, blurry text, or inconsistencies in fonts.

By following these steps, you can become a W-2 verification pro and protect your rental community from fraudulent applications.

How to Verify Pay Stubs

The rental process usually involves income verification, but you may need more than pay stubs to complete it. Instead of relying solely on questionable check stubs, ask for at least two income and employment verification forms. With these in hand, you'll have an easier time spotting inconsistencies and fraudulent information.

You might wonder ‘how are pay stubs verified?’ Here are a few documents you can request during the rental application process:

- Employment Verification Letter: Ask your renters for an employment verification letter from their HR department or supervisor.

- 1099 Tax Form: Contractors and freelancers will not have W-2 documents but should be able to supply a 1099 tax form to verify their income.

- Social Security Statements: If a tenant collects social security, you can ask them to supply their forms to see how much money is coming into their bank account each month.

- IRS Form 1040: Instead of asking for a renter's full tax return, inquire about the 1040 form they fill out and send to the IRS when filing taxes.

- Court-Ordered Payments: A tenant may have court-ordered payments from a financial settlement or divorce that can prove their financial stability.

- Annuity Statement: Potential renters may have an annuity to draw from or a contract from an insurance company where money is invested and regularly distributed.

Additional Verification Methods

If you're still unsure whether you have the correct information or your tenant claims they don't have the documents you want, there are a few more verification methods you might consider.

- Request a W-2: The income listed on a W-2 should be consistent, short of any commissions or bonuses that raise their base pay.

- Direct Employer Contact: Directly reach out to the company with a phone call. Also search the number and place of business on Google to ensure it's a legitimate business.

- Ask for Bank Statements: They should corroborate the income amount from the pay stub and demonstrate a consistent deposit history.

- Run a Credit Check: You can run a credit check under the Fair Credit Reporting Act. You will need a "permissible purpose," such as verifying information for housing purposes.

- Verify the Legitimacy of the Payroll Company: Check the payroll provider’s information. For example, an ADP pay stub comes with detailed information about wages, withholding, and benefits.

Clear communication with your leasing applicants is key throughout the verification process. By combining a keen eye for red flags with these verification methods, you can confidently assess applicant income and make sound leasing decisions.

Safeguard Your Rentals & Take Control of the Leasing Process

Income verification remains a cornerstone of responsible tenant screening. By following the strategies outlined in this blog post, you can significantly reduce the risk of encountering fake pay stubs and protect your rental business.

At Apartment List, we understand the importance of streamlined and secure tenant screening. Ready to find qualified renters and fill your vacancies quickly? Apartment List's advanced AI technology seamlessly matches your listings with highly compatible, ready-to-move renters. Get in touch to get started today.

Share this Article